Protecting Yourself

- Friendly expert advisors

- We work with a panel of lenders

- Over 190 5-Star Google Reviews

Get in touch for a free, no-obligation chat about how we might be able to help you.

Contact Us

Home » Protecting Yourself

Protecting Yourself

You’ve got your loan, you’ve insured your property and contents, you’ve settled in and then – bang! The unexpected happens. It might be an accident, sickness or a period of unemployment. It could even be your death. The last thing you, or your loved ones, need on top of that is to be unable pay the mortgage and be at risk of losing your/their home.

Protecting yourself means thinking about some unpleasant scenarios, but the reality is that without you and your ability to repay the mortgage, the home you’ve strived so hard for could be at risk.

Think of yourself as a ‘Golden Goose’, and your income is the ‘Golden Eggs’ that pay for your home. Without the goose, there are no eggs – so you need to ensure that the goose is protected, and egg production continues.

Protecting yourself means putting in place insurance in case of:

- Death

- Critical or serious illness or serious illness – you have a non-fatal, but life changing condition like a stroke or heart attack

- Inability to work – you have a condition that is non-critical, but means you are unable to create income

- Accident Sickness Unemployment

We can help you with insurance cover to minimise the effects of unexpected and unwelcome events. With the right personal protection in place, you can look to the future with confidence knowing the roof over your head is safe.

We do not provide advice on Health Insurance, however, we can refer you to a third party who can.

With your consent, we’ll take your name and email address and pass these on directly to the third party, who will then use these details to contact you in relation to your enquiry

At a time of loss, the last thing a family needs is their daily routine upset because of financial worries. So, don’t take a rain check on life cover. After all it could help protect the lifestyle of those you love.

Taking out life cover could leave your family in a better position to be able to afford the everyday things they’re used to. Because if money’s really tight all the things that made life special while you were still around, could be threatened for years to come.

A life insurance policy is not a savings or investment product and has no cash-in value. It is only paid out on death.

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

Increasing Term Assurance Cover

Increasing cover

- Choose how much you want your cover to increase by each year

- Pays a lump sum if you die or become terminally ill

- If you have life cover and critical illness, pays your lump sum on diagnosis of a serious illness

- Good for protecting against the rising cost of living

- Choose single or joint cover (covering you and a partner)

Additional info

- We set your increasing rate at the start of your policy

- You can ask us to increase your cover by 3%, 5% or in line with Retail Prices Index (max 10%)

- We apply the increase once every year on the anniversary of the policy start date

- Your premium goes up 1.5% for every 1% increase in cover (because the risk increases as you get older)

- If you have multi-fracture cover included, the cost of this will stay the same

- You can change to Level cover at any time

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

Level cover

- Your cover and payments stay the same during your policy (unless you change them)

- Pays a lump sum if you die or become terminally ill with less than 12 months to live

- If you have life cover and critical illness, pays your lump sum on diagnosis of a serious illness

- Good for financially protecting you and your family, an interest-only mortgage or loan

- Choose single or joint cover (covering you and a partner)

Additional info

- You may be able to increase your cover at certain milestones, such as moving house or having a child without having to answer any medical questions. Bear in mind an increase in cover will mean an increase in premium

- We’ll also consider other requests to increase cover

- You can reduce your cover at any time

- You can reduce the length of time you’re covered for

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

A normal life insurance will provide a lump sum payment that may be vital to keep a roof over your hear. What the point of having a roof if a family will still struggle to meet day-to-day living costs even if the mortgage has been paid off.

Family Income Benefit is an affordable way to plug this gap. Your advisor will aimto help you establish what the right amount of cover would be for your needs, and cover can be paid out either monthly or annually

The pay out is a tax-free monthly income until the end of the term selected, on the death or diagnosis of a terminal illness.

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

Decreasing cover

- Cover decreases each month, reaching zero at the end of your term

- Pays a lump sum if you die or become terminally ill

- If you have life cover and critical illness, pays your lump sum on diagnosis of a serious illness

- Good for protecting a repayment mortgage

- Choose single or joint cover (covering you and a partner)

Additional info

- Premiums are calculated at the start and stay the same

- We’ll set the percentage rate at which your cover reduces

- You can ask us to change this rate to suit your circumstances

- You can choose a fixed rate of between 2% and 18%

- You can choose a higher rate than your mortgage/loan interest rate

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

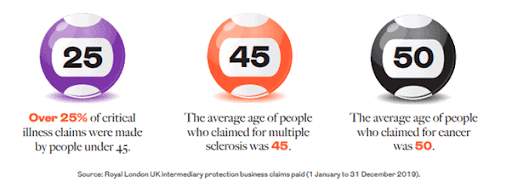

For most of us our biggest concern would be surviving the illness and recovering from it. But it can be difficult to focus 100% on getting better if you’re worried about your finances. Sadly, this is a reality for many families whose lives have been turned upside down by illness.

It pays out if you get one of the critical illnesses covered, and it meets the definition in your plan. So you can buy yourself time. Time to recover, time to make plans if your illness has long-term consequences, and time to spend with your loved ones if your illness is terminal.

Critical illness insurance provides you with a lump sum of money if you are diagnosed with certain illnesses or disabilities covered specified in a plan.

The kinds of illnesses that are covered are usually long-term and very serious conditions such as a heart attack or stroke, loss of arms or legs, or diseases like cancer, multiple sclerosis, or Parkinson’s disease.

Will you be left you out of pocket if you got a critical illness? Would it be handy to have a large sum of money to spend on things like everyday expenses, paying off your mortgage or your medical expenses? You can use the money in any way you like, you don’t have to spend it on anything in particular.

To find the right protection to protect you and your family or even think about if you need it, speak to your advisor.

This is subject to full medical history disclosure, subject to eligibility/terms of providers criteria

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

Critical illness plans may not have cover all the definitions of critical illness. The definitions vary between product providers and will be descried in the key features and policy document if you go ahead with a plan.

Health Insurance

With the NHS so stretched. Why not take matters into your own hand and get cover to pay for quick access to private facilities and treatments. Private medical insurance (PMI) can help pay for any high, unexpected private medical bills you may need covered. This could be anything from physiotherapy sessions, to major heart surgery. PMI also plays an important role in funding the early

diagnosis of critical conditions.

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

If you were too ill to work, how would you cope? Between September and November 2019 there were over 2 million people of working age in the UK who were unable to work due to long-term sickness. * If you were among them, would you be able to cover your day-to-day bills without your full regular income to rely on? Or would you find yourself struggling financially at a time when money should really be the last thing on your mind?

*Office for National Statistics, Labour Market statistic summary tables published January 2020.

Income protection is insurance to help you cope with these circumstances. It pays you a monthly income if you’re too ill to work, helping you cover your costs and allowing you to focus on your recovery. You can claim if you meet the definition of ‘incapacitated’ in your income protection plan.

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

Income protection (with no investment link) has no cash in value at any time and will cease at the end of the term. If you stop paying premiums, your cover may end

Much like machinery, people break down too, so it makes sense to have protection in place to maintain ‘business as usual’ Losing a key person like a director, partner, member or having a key employee suffer a critical illness or die, could threaten the financial stability of your business.

Key person cover gives your business capital if a key person gets a critical illness* or dies. Don’t let the loss of a key person put your business in a spin. *Not all insurers cover the same illnesses, and definitions for illnesses may vary.

Key person protection – to protect against loss of revenue if a key employee dies or can’t work because they’re critically ill.

Ownership protection (also known as partnership and shareholder protection) Losing a partner, member or shareholding director can have a major impact on the success of a business. But it’s not just the loss in profits that would have an impact. How do you retain control and assign fair value?

Loan protection – One of the biggest challenges to the success of many businesses is finding the money to set up or expand. And if you’re not fortunate enough to find someone willing to invest in your business, you may have to borrow to achieve your plans. This type of protection can help repay outstanding financial commitments, such as director loan accounts or bank overdrafts, if the worst should happen to a key person or shareholder.

If the policy has no investment element, then it will have no cash value at any time and will cease at the end of the term. If premiums are not maintained, then the cover will lapse

Business Protection (with no investment) has no cash in value at an time and will cease at the end of the term. If you stop paying your premiums your cover may end.

Useful links

Why us?

- We offer trusted expert advice

- We treat your home as if it was our own

- We have over 190 5-Star Google Reviews from our clients

Our Approach

Personalised – there is no ‘one size fits all’ when it comes to property advice. Your needs are not the same as anyone else’s and nor is our advice. We spend time getting to know you and your motivation for purchasing a property.

Choice – we’re a mortgage broker, so we have the widest possible range of options.

Technology and expertise – we use a combination of cutting-edge tech and 35 years of good old-fashioned financial expertise to find the right loan for your circumstances.

Efficient – we admit it, we’re a little bit obsessed with streamlining. Our inspiration is Formula One – did you know that in 1950 a pitstop took 67 seconds? Today it takes 2. The difference? Organisation, training, and tools. We’ve learned from that and have streamlined our processes to get you into your property faster and hassle-free. Our case studies speak for ourselves!